Recently, I've discovered the blog of Robert Ochtel. He's an author and a serial entrepreneur with over 25 years experience. He's also raised over $50 million for his businesses, and started VentureBlue, a national Angel network. And, he's just up the road in Carlsbad, CA.

Robert wrote a post explaining why entrepreneurs should be comforatble and intimately involved in the company financials. Most VC's hail from business schools and if they have not ran a company themselves, they do know how to analyze financial statements. So it becomes paramout that the entrepreneur be able to explain the projections and the assumptions underlying them.

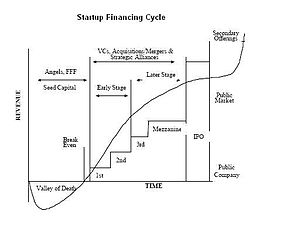

Image via Wikipedia

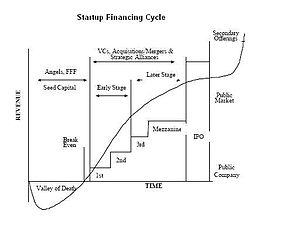

Image via Wikipedia

Don't defer your financials to someone else. You can have mentors help you with it, but it's important that you, as the CEO, understand the key variables that shape your business. By doing so, you can understand why your projections were off (which, in most cases, they will be).

![Reblog this post [with Zemanta]](https://www.stevencox.com/https://www.stevencox.com/wp-content/themes/wp-prosper-20/images/reblog.png)